States and regions also become sick besides companies and human beings. When they become sick, you get a doctor, then you dose the patient with some foul smelling medicine, and then you get better, and to stay better, you keep on doing good healthy things so that you do not fall ill. But then, there are some fellows who will smoke, drink, eat fatty foods, then get a heart attack, and then continue on with being a bad old egg.

But what's with Bimaru in the title? It is a play on words, the word itself stands for 4 Indian states, Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh. When you select those letters together, they mean sick (Bimar in Hindi means sick). And yes, Sir, they are sick in terms of almost every socio-economic indicator that is going.

Obviously, the reasons are multifarious, but mainly is because of the venality of the politicians of all stripes. Corruption is rife, illiteracy rampant, health is poor, economics horrible, generally a sad old reflection of what India's missed opportunities are. What makes it even worse is that these are poor states in a poor country, but other states have done much better. I realise that somebody has to come bottom, but when we are talking about poverty levels which are at or below starvation levels, then being at the bottom has severe implications for rest of the country. It does not also help that these states are some of the most populous in the country.

One would expect that every state would be hell bent in trying to improve its investment climate so that jobs are produced and better quality of life is achieved. But no, most of the leaders of these states are too busy being corrupt and feathering their own nests. By and large, they are a venal lot, seriously. And having had experience of living, studying, working, running firms in these states, I can personally say that the situation isnt improving fast. For entrepreneurs, it is tough, really tough. When you have borrowed money from your father's General Provident Fund (pension fund), and have invested in the anticipation that you will provide sufficient returns so that your old man is not left on the street, the last thing you need is your own government and its officials being like vultures, bent on capturing your hard earned money. Well, perhaps it is too much to expect, but what exactly are the problems facing entrepreneurs?

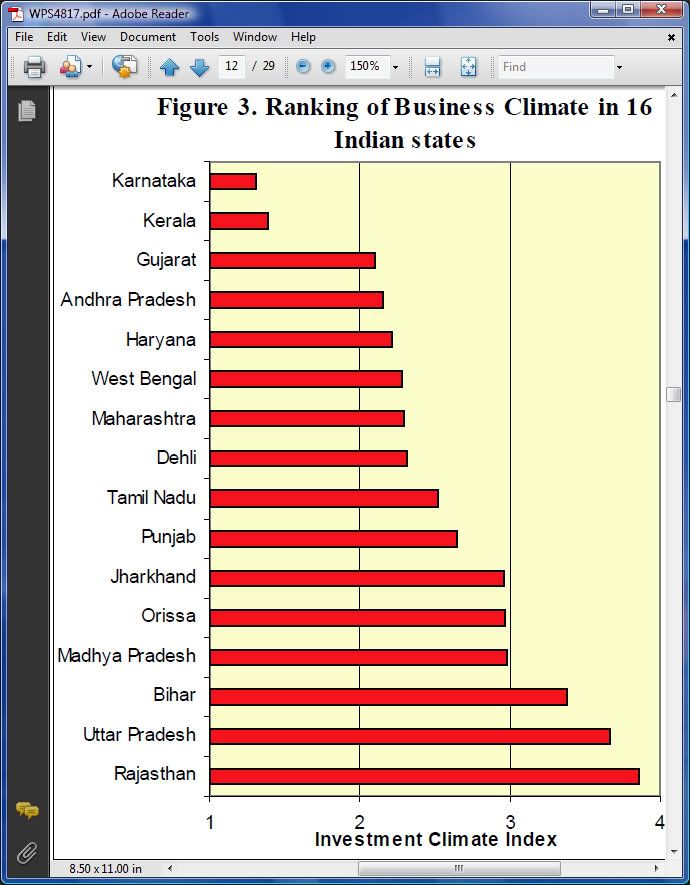

The World Bank recently released a paper comparing the investment climate in 16 Indian states for which they had data. Here's their main graphic which shows the investment climate in the 16 states.

So what did the author evaluate to make up the index? This is what I mean by saying that the issues with these states are simple but implementation needs just simple hard work. Nothing magical, just keep on plugging away at it. Here are some of the factors relating to infrastructure: Hours of power outages last year, Hours of telephone outages last year, Percentage of sales lost in transit, percentage of sales lost due to power outages, Days of inventories kept for main input (proxy for quality of transportation). What about inputs? Excess labor, Cost of finance: value of collateral required to obtain a loan, Proximity to raw materials (share of inputs bought by domestic sources) Proximity to domestic customers, Share of firms using new technology, Trade credit: share of sales sold on credit, Trade credit: share of inputs bought on credit.

Finally institutions make a huge amount of difference to the investment climate and the authors included security cost, losses due to theft , Manager time spent dealing with regulations, Days spent with officials to deal with regulations, consistent interpretation of rules, Tax evasion (% of sales not declared), Days to obtain a telephone connection, Days to obtain a electric connection, Days to obtain a construction permit, Bribes to "get things done", Share of firms reporting officials request gifts etc. etc.

While one can only exhort the states at the top to do much better, but its the stogy lump of undigested mass of states at the bottom which is the issue. Not only do the good state's get their tax revenues diverted to support these Bimaru states, the diversion of tax revenues is then not invested in productive matters. So, all in all, these are giant holes where a significant proportion of productive wealth generated by India disappears.

The concluding paragraph from the author is particular important but would not be particularly surprising.

The analysis of 46 investment climate variables shows that power, transportation, corruption, tax regulations and theft

remain the major bottlenecks policymakers need to address in order to improve the business environment in India.

Same old, same old. Long way to go, my friends, long way to go.