So now Sir Stephen Bubb says that bank bonuses should be taxed and proceeds given to charities. Oh! very nice of you, mate. Next idea presumably would be to force people to grow green hair? Or how about forcing people to pay £1 every time they have a McDonald burger? How about forcing people to pay £1 every time they switch on their tv’s? Or every time they fill up their tanks with petrol?

Taxes are compulsory, mate, you pay them so that there is a state which looks after basic needs. Charity, on the other hand, is voluntary. This basic idea seems to have passed you by, you fascist ignoramus. Why call yourself as a charity if your funding is based upon government levied taxes? Shame, this is so highly illiberal. The story also says, and I quote:

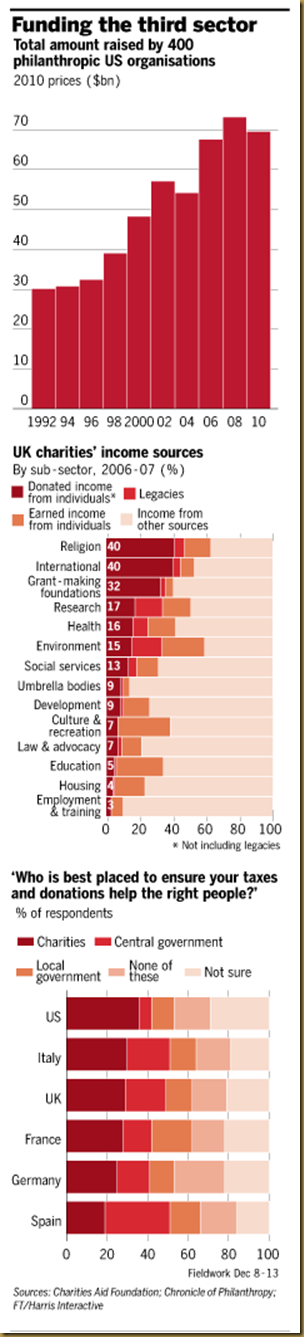

Last month, a survey by the Charity Finance Directors Group, consultants PWC and the Institute of Fundraising, found that a third of charities nationally that receive state cash say they will have to reduce the level of services they provide. More than a quarter expect to make staff redundant and the charity thinktank New Philanthropy Capital estimated that the voluntary sector's income from state sources could shrink by between £3bn and £5bn as a result of the cuts.

Assuming that the reduction is about 25% (same scale of normal government cuts), this tells me that this forcible contribution via taxes to the charity sector is to the range of £15bn and £20bn. That is about 10-13% of the annual income tax take by the government. What the hell? We pay £43bn in yearly interest costs, there’s a place where you can spend this £20 billion in charity funding. What on earth is this stupid thing? Go see the fakecharities.org site. Here’s a great example:

An independent employment charity which works nationally with the long-term unemployed, helping people overcome personal barriers so that they can move into long-term, sustainable jobs. Our objective is to help those who are furthest from the labour market to get and keep a job, by preparing them for work and supporting them through their individual return-to-work programmes.

Very good stuff, its good to hear that private citizens are putting their money to help their fellow citizens get back to work. No? no!

The Charity’s accounts for the financial year ending 31 March 2009 show an income of £7,981,260 and expenditure of £7,620,171. The charity’s income includes £6,717,834 funding from regional Government Offices, local authorities and the London Development Agency.

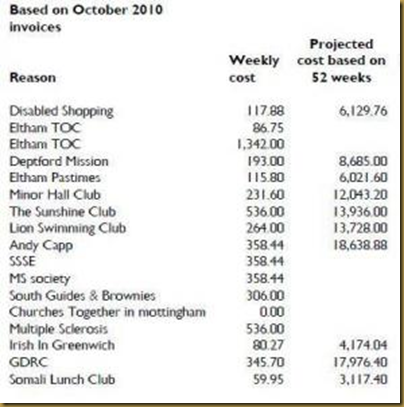

You are welcome. The mind boggles. Here is an example of what local council’s fund out of your council tax and general taxation.

Why are we funding Irish in Greenwich or a Somali Lunch Club? Or a swimming club? Good lord.